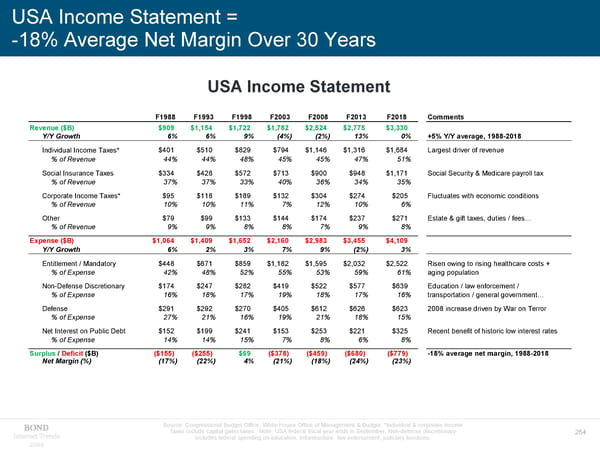

USA Income Statement = -18% Average Net Margin Over 30 Years USA Income Statement F1988 F1993 F1998 F2003 F2008 F2013 F2018 Comments Revenue ($B) $909 $1,154 $1,722 $1,782 $2,524 $2,775 $3,330 Y/Y Growth 6% 6% 9% (4%) (2%) 13% 0% +5% Y/Y average, 1988-2018 Individual Income Taxes* $401 $510 $829 $794 $1,146 $1,316 $1,684 Largest driver of revenue % of Revenue 44% 44% 48% 45% 45% 47% 51% Social Insurance Taxes $334 $428 $572 $713 $900 $948 $1,171 Social Security & Medicare payroll tax % of Revenue 37% 37% 33% 40% 36% 34% 35% Corporate Income Taxes* $95 $118 $189 $132 $304 $274 $205 Fluctuates with economic conditions % of Revenue 10% 10% 11% 7% 12% 10% 6% Other $79 $99 $133 $144 $174 $237 $271 Estate & gift taxes, duties / fees… % of Revenue 9% 9% 8% 8% 7% 9% 8% Expense ($B) $1,064 $1,409 $1,652 $2,160 $2,983 $3,455 $4,109 Y/Y Growth 6% 2% 3% 7% 9% (2%) 3% Entitlement / Mandatory $448 $671 $859 $1,182 $1,595 $2,032 $2,522 Risen owing to rising healthcare costs + % of Expense 42% 48% 52% 55% 53% 59% 61% aging population Non-Defense Discretionary $174 $247 $282 $419 $522 $577 $639 Education / law enforcement / % of Expense 16% 18% 17% 19% 18% 17% 16% transportation / general government… Defense $291 $292 $270 $405 $612 $626 $623 2008 increase driven by War on Terror % of Expense 27% 21% 16% 19% 21% 18% 15% Net Interest on Public Debt $152 $199 $241 $153 $253 $221 $325 Recent benefit of historic low interest rates % of Expense 14% 14% 15% 7% 8% 6% 8% Surplus / Deficit ($B) ($155) ($255) $69 ($378) ($459) ($680) ($779) -18% average net margin, 1988-2018 Net Margin (%) (17%) (22%) 4% (21%) (18%) (24%) (23%) Source: Congressional Budget Office, White House Office of Management & Budget. *Individual & corporate income taxes include capital gains taxes. Note: USA federal fiscal year ends in September. Non-defense discretionary Internet Trends includes federal spending on education, infrastructure, law enforcement, judiciary functions. 264 2019

Internet Trends 2019 - Mary Meeker Page 110 Page 112

Internet Trends 2019 - Mary Meeker Page 110 Page 112